Checking Built for Your Life

Texans are on-the-go, heads-down, powerhouses. A checking account that simplifies your life, now that’s a non-negotiable. That’s why we provide two different account options that work hard to make your life easier.

Texans Two-Step Checking

Enjoy everything there is to love about the My Texans Checking account, PLUS earn extra interest on your linked savings account and get ATM fee refunds, all with no monthly service fee.*

- Earn high yield interest – Earn 3.75% APY^ on balances up to $20,000 in your linked Texans Savings account.* Balances over $20,000 earn 0.01% APY.^

- Get ATM fees refunded – Monthly refund of up to $15 in out-of-network ATM fees and up to $7 in international ATM fees.*

- Avoid monthly service fees – Regular monthly service fee of $15 is waived with a monthly direct deposit of $2,000 or more to your account.*

- Get paid up to two days early with Direct Deposit and access your hard-earned money sooner.

- Effortlessly save & give by rounding up your debit card purchases to the nearest dollar with Texans Roundup. Automatically save your spare change, donate it to causes you care about, or both.

- Manage your debit card any time, anywhere with Texans Card Manager tool

- Maintain peace of mind with Overdraft Protection and the ability to turn your card off and on in the app

My Texans Checking

Our most popular checking account is perfect for everyday use and simplifies your life with:

- Get paid up to two days early with Direct Deposit and access your hard-earned money sooner.

- Texans Visa Debit Card – Use everywhere Visa is accepted and access your money at more than 80,000 Surcharge-Free ATMs.

- Manage your account easily with the Texans CU Mobile App, including Mobile Deposit, Texans Card Manager, and more.

- Send and receive money quickly and securely with Zelle®.

- Effortlessly save & give by rounding up your debit card purchases to the nearest dollar with Texans Roundup. Automatically save your spare change, donate it to causes you care about, or both.

- Financial planning tools available in Digital Banking help you keep your credit on track and meet your savings goals.

- Maintain peace of mind with Overdraft Protection and the ability to turn your card off and on in the app.

- FREE notary service

ENJOY CONTACTLESS PAYMENTS

Tap to Pay

Checking out has never been faster or more secure. Simply tap your Texans Visa Debit Card and be on your way!Mobile Wallet Ready

Keep your card right in your phone - great for on-the-go purchases with a quick tap of your phone!Shopping Made Easy

Online or in-store, your Texans Visa Debit Card is ready to go. Accepted everywhere that takes Visa.

Manage Your Account on the Go

With digital banking you can view account balances and past statements, make payments, transfer funds, manage your cards, and more in our mobile app or online.

- Keep up with your cards 24/7 with Card Manager

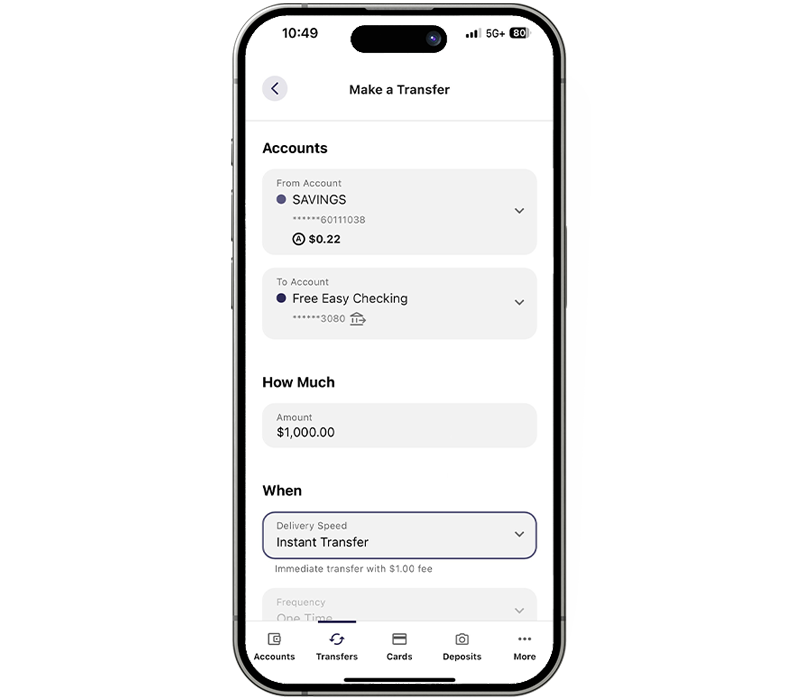

- Move money in seconds with Instant Transfer

- Easily send money to family & friends with Zelle

- Automate your savings & give effortlessly with Texans Roundup

- Take control of your credit score with Credit Connection

TEXANS CREDIT UNION IS ALWAYS AHEAD OF THE CURVE WITH BENEFITS1

- Cellular Telephone Protection

Get reimbursed if your cell phone is stolen or damaged when you use your Texans Visa debit card to pay your wireless cell phone bill.

- Dovly Uplift

Benefit from a higher credit score with credit monitoring and dispute management with Dovly Uplift. Put Dovly to work helping to fix, manage, and maintain your credit score.

- Roadside Dispatch

As a Texans Visa debit cardholder, you have access to Roadside Dispatch®, a pay-per-use roadside assistance program that arranges a dispatch to a reliable tow operator or locksmith.

Need after hours debit card help?

We're here for you 24/7. Call 1.800.843.5295 to get help with fraud alerts, lost or stolen cards, transactions, card activation, travel, Card Manager, and more.

Texans Visa Debit Card FAQs

You can tap to pay where you see the Contactless Symbol on a checkout terminal. Millions of places around the world accept contactless payments, including fast-food restaurants, coffee shops, grocery stores, retail pharmacies, vending machines, taxis and more.

^ APY = Annual Percentage Yield. APY is accurate as of 12/01/2025.

* Each qualification cycle (1st of the month through last day of the month) that you have direct deposits of $2,000 or more to your Texans Two-Step Checking: (a) the monthly service fee of $15 will be waived; (b) two (2) Non-Texans ATM transaction fees of $7.50 each and two (2) International ATM transaction fees of $3.50 each incurred during the qualification cycle will be refunded to your Texans Two-Step Checking account on the first day of following month; and (c) balances on your Regular Savings account, up to $20,000, will earn the 3-month Standard Certificate of Deposit rate (3.75% APY as of 12/01/2024). Balances over $20,000 will earn the same rate as the Regular Savings account (0.01% APY as of the last dividend declaration date), resulting in 3.75% to 0.25% APY, depending on your account balance. Direct Deposit is defined as deposits via an Automated Clearing House (ACH) originated from another financial institution (ex. payroll, social security, incoming ACH from an external account). A direct deposit does not include peer-to-peer transfers from services such as PayPal, Zelle, Cash App, or Venmo, mobile check deposits, cash loans or deposits, and any deposit which Texans Credit Union deems to not be legitimate are not considered Direct Deposits. If you do not meet the direct deposit minimum, fees will not be waived, ATM fees will not be refunded, and balances in your Regular Savings will earn the same rate as the Regular Savings account (0.01% APY). Rates are variable and subject to change without notice. Limit one Texans Two-Step Checking account per member. No minimum balance required to open a Texans Two-Step Checking account. Minimum balance of $5 required to open a Regular Savings account, and a minimum balance of $25 is required to earn dividends. Fees may reduce earnings. A $2 paper statement fee will apply if not enrolled in e-statements with a valid email address.

** The monthly service fee of $5 is waived with any monthly direct deposit to your My Texans Checking account or enrollment in e-statements.

1 Full benefits explained in the Texans Visa Debit Card Guide to Benefits disclosures provided with card agreement. Ask a Texans representative for more details.

You must have a Texans checking account with a Texans debit card to enroll in Roundup. Debit card transactions will be rounded up to the nearest dollar and that amount will be transferred from your checking to your specified savings account or designated charity. A receipt will be provided at the end of the month for the charitable donations made through Roundup. The checking account balance must be sufficient to process the transaction. The transaction will not occur if the account balance is zero, becomes zero, or negative after the round-up transaction. ATM transactions are not included in the Roundup program. For more information, click here.

In the Giving Center, you have the option to do a one-time donation to a charity you select from the options available. You may make a donation from a Texans savings, checking, or money market account. In most cases, the transaction will occur in minutes. A receipt will be provided at the time of the transaction.

We may cancel or modify the Savings/Charity programs at any time without prior notice.